Town Resources

Reports & Commitment Books

- 2024 Real Estate Tax Commitment By Map & Lot

- 2024 Real Estate Tax Commitment By Name

- 2024 Personal Property Tax Commitment By Name

- 2023 Real Estate Tax Commitment By Map & Lot

- 2023 Real Estate Tax Commitment By Name

- 2023 Personal Property Tax Commitment By Name

- 2022 Real Estate Tax Commitment By Map & Lot

- 2022 Real Estate Tax Commitment By Name

- 2022 Personal Property Tax Commitment By Name

- 2021 Real Estate Tax Commitment By Name

- 2021 Real Estate Tax Commitment By Map – Lot

- 2021 Personal Property Tax Commitment By Name

- 2020 Personal Property Tax Commitment Book

- 2020 Real Estate Tax Commitment Book – Map & Lot

- 2020 Real Estate Tax Commitment Book – Alphabetical

- 2020 Annual Report

- 2019 Audit Report

- 2019 Annual Report

- 2019 Personal Property Tax Commitment Book

- 2019 Real Estate Tax Commitment Book – Alphabetical

- 2019 Real Estate Tax Commitment Book – Map & Lot

Town Report and Meeting Warrants

Selectboard Meeting Agendas

NOTICE TO ATHENS RESIDENTS: TO REQUEST ADDITION OF ITEMS TO THE AGENDA FOR A SELECTBOARD MEETING, PLEASE EMAIL THE SELECTBOARD AT: townofathens@tds.net

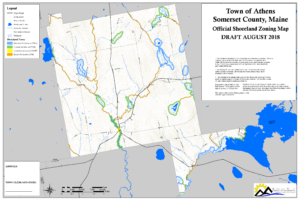

Shoreland Zoning

Food Cupboards Open to Athens Residents

Location 1:

Cornville-Athens People Who Care, 493 West Ridge Road, Cornville, ME Hours: Open 1st Saturday Each Month 9:00 AM To Noon

For More Information: (207) 399-0452 or shannondrury@rocketmail.com

Location 2: Harmony Cares Food Cupboard, 20 Main St. Harmony, ME Hours: Open First & Third Saturday of each month, 9:00AM To 11:00 AM Open Mondays following the First & Third Saturdays, 5:00PM to 6:00PM For More Information: 207-249-1676

Tax Valuation Date

Under Maine State Law, the ownership and valuation of all real estate or personal property subject to taxation shall be fixed as of April 1st. For fiscal year 2025-2026, that date was April 1, 2025.

Personal Property Tax

Any assets owned or located in Athens for use in business are eligible for taxation by property tax; the tax rate is the same rate as applied to taxable real estate. For example:

Machinery & Equipment: Presses, tools, machining equipment, garage equipment, heavy-duty shelving and other machinery or manufacturing equipment, telephones, vending machines, televisions, fax machines, copiers, office equipment

Furniture & Fixture: Desks, chairs, bookcases, filing cabinets, tables

Computer Equipment: Computers, monitors, servers, printers, smartphones

Miscellaneous Personal Property: Trailers, cargo, bulk hauling, storage, office, law library, art work

Businesses are required to provide the Athens Board of Assessors with a true and perfect list of personal property assets located in Athens as of April 1st, 2025.

If your business is open as of April 1st, you are responsible for personal property taxes for the entire fiscal year.

Failure to file a true and perfect list of assets bars a taxpayer’s right to appeal his or her valuation for that year, M.R.S. Title 36 § 706-A.

Veterans Exemption

Any veteran who will be 62 years old on or before April 1, 2024 or any Veteran who is 100% disabled may be entitled to an exemption for a portion of the property tax. In order to qualify for the Veteran’s exemption, a person must have served during a wartime period, or be an unmarried widow or widower of a veteran that meets the requirements. Anyone who is not already receiving a veteran’s property tax exemption, but feels they would qualify should contact the Athens Assessor’s office either by mail (P.O. Box 146, Athens, ME 04912) or phone (207-654-3471).

Homestead Exemption

The Maine Homestead Exemption may lower your property tax bill. It makes it so the town won’t count a portion (up to $25,000) of value of your home for property tax purposes. You can qualify if you have owned your home in Maine for at least 12 months. Contact the Town Office for forms or more information.